Just got a shiny new Capital One card in the mail? Congrats! 🎉 But don’t get too eager to start swiping – you’ve gotta activate it first.

Activating your card is a quick and easy process to get your card ready for action. This step verifies your identity and connects your card to your Capital One account.

In this handy guide, I’ll walk through the three ways to activate your Capital One credit or debit card:

- Online

- Via mobile app

- By phone

I’ll also cover some common questions around receiving, accessing, and managing your Capital One card account. Sound good? Let’s dive in!

Contents

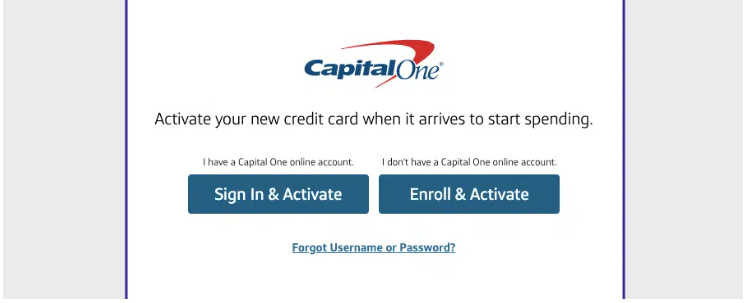

Capitalone.com/activate Card Online

Activating online is my personal fave because you can get it done fast without talking to anyone. 😅

Here’s how:

- Head to the Capital One activate page

- Sign into your Capital One online account

- Or enroll if you need an account

- Select “Activate Your Card“

- Enter the 3 digit security code from the back of your card

- Follow the instructions to complete activation

And just like that, your card will be primed and ready for purchases! 💳

Activating Via Mobile App

Prefer to activate on your phone or tablet? Capital One’s mobile app makes it easy.

Just:

- Download the Capital One mobile app

- Sign into your account

- Tap “Activate My Card“

- Provide the security code when asked

- Wait for the “Your card is activated!” message

Then it’s all systems go for mobile payments!

Pro Tip: If you have an Android device, set up contactless pay through Google Pay. Super convenient!

Activating By Phone

Last but not least, you can activate through an automated phone system.

Here’s the drill:

- Call the number on the back of your new card

- When asked, enter your card security code

- Follow the phone prompts to activate

Remember to call from the phone number associated with your Capital One account. Otherwise, you’ll have to answer security questions for verification.

And that’s it! Your card will activate once the automated system has your details.

Insider Tip: The phone activation is available 24/7 so it’s handy if you need to activate ASAP.

Other Key Questions Around Activating Your Card

Now that you know how to activate that new piece of plastic, here are some other common questions around getting started:

How can I check on my card application status?

You usually get an instant response when you apply online or over the phone. But if Capital One needs any follow up verification, it can take 7-10 days to get your official approval/denial letter.

To check status in the meantime, call 1-800-903-9177.

How long until my card arrives once approved?

Delivery timeframes range between 7-10 days. If it’s been more than two weeks, give Capital One a ring to track it down.

Can I add an authorized user to my account?

You sure can! As the primary cardholder, you have the power to add authorized user cards connected to your account via online banking or phone support.

This lets you assign spending limits and track purchases. Perfect for letting that new teen or family member use your card! 👪

I need help accessing my account!

No worries, happens to the best of us. On the Capital One login page, select “Forgot Username/Password” to recover your details and regain access.

Still stuck? The online chat support is great for instant help getting into your account.

Let’s Get Spending!

The key to quickly activating any Capital One credit or debit card is having your 3-digit security code handy.

With that, you can get your card up and running through the online account, mobile app, or automated phone system within minutes!

Then come the fun part – putting your card to work! Just remember to make payments on time and live within your means.

Wishing you happy and responsible spending ahead. Let me know if any other credit card questions pop up! 💳