Hey there! If you’re looking to shop online securely without sharing personal details with merchants, SecureSpend cards may be perfect for you. These nifty prepaid Visa cards allow you to shop while protecting your identity.

In this beginner’s guide, we’ll cover:

- What SecureSpend cards are

- Their main benefits

- How to activate and use them

- Checking your balance

- Frequently asked questions

Contents

An Introduction to SecureSpend Cards

A SecureSpend card is essentially a prepaid Visa gift card that comes with extra security features. When you buy one, funds are immediately loaded onto the card. Then you can use it to shop online or in stores, just like a debit or credit card!

The biggest perk is privacy – since it’s prepaid with your funds, no personal details are linked to the card. There’s no credit check or bank account required, making it super quick and easy to get. Most people who apply receive their card in the mail within a week.

Once activated, feel free to add more funds and use it anywhere Visa debit is accepted. That includes over 100K online stores like Hulu, PSN, Xbox Live, Airbnb, and more. It’s reloadable too, so you can keep adding funds as needed.

3 Great Reasons to Get a SecureSpend Card

1. Shopping Security

SecureSpend cards allow you to shop online without sharing sensitive info like your SSN or credit card details. Instead of exposing that data, simply use your prepaid funds to make purchases!

2. Total Privacy

Since they aren’t linked to your bank account or credit, SecureSpend cards help you maintain privacy. To sellers, it will appear you’re making debit/credit card purchases like normal. But in reality, only the details specific to your prepaid SecureSpend card will be shared during transactions.

3. No Credit Checks

Anyone over 18 can get approved for a SecureSpend card, regardless of credit history. As long as you have the funds to preload onto the card, you’re ready to shop securely!

Activating and Using Your SecureSpend Card via SecureSpend website

When your new card arrives in the mail, you’ll need to activate it before making any purchases.

Here are step-by-step activation instructions:

- Register for an account on the SecureSpend website. Just provide your email, create a password, and answer two security questions.

- Sign into your new SecureSpend account.

- Add your new card by entering the card number, expiration date, and security code found on the back.

Once activated, you can immediately begin shopping with it online or in stores! Just keep the following usage tips in mind:

- When checking out, select “Credit” or “Debit“, then enter your card details (NOT gift card).

- Be sure your SecureSpend card has enough funds to cover the full purchase amount before attempting transactions.

- Use the same billing + shipping address to avoid issues.

And that’s it! Now you’ve got a prepaid card all ready to start shopping online, without compromising personal financial info.

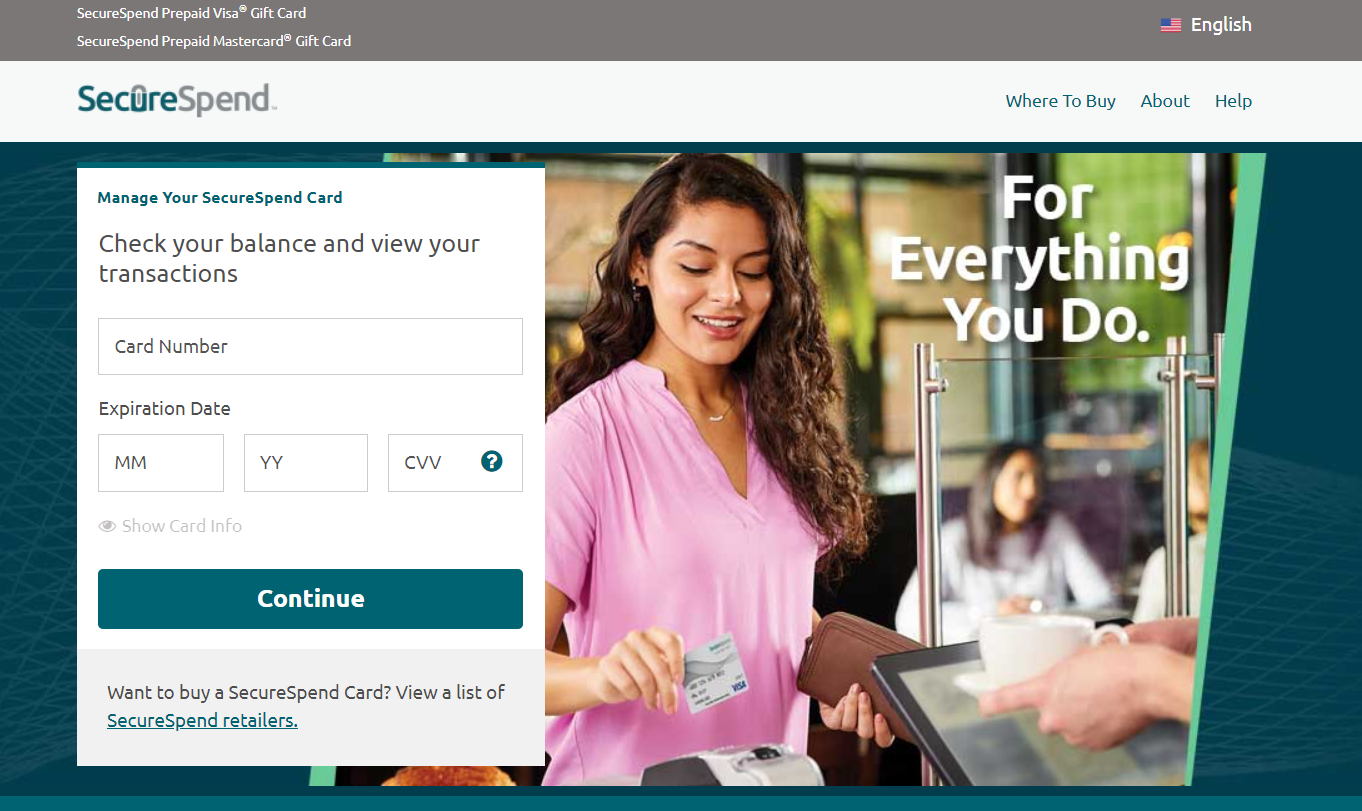

Checking Your SecureSpend Balance

Wondering how much you have left to spend on your SecureSpend card? Checking your balance is easy.

- Visit the SecureSpend website and sign into your account

- Enter your card number and expiration date

- Click “Sign In”

- View your current balance and transaction history

You can also call anytime to check your balance via automated phone system.

Common Questions About SecureSpend Cards

Here are answers to some frequently asked questions:

Are there any fees?

Nope! No surprise fees or overdraft charges to worry about.

Where can I use my SecureSpend card?

Anywhere Visa debit cards are accepted – both online and offline. That includes over 100K stores!

What’s the minimum I need to get a SecureSpend card?

Just $10! You can also opt for cards preloaded with $100 to $5,000.

Is it refundable?

Yup! Just call customer support anytime to request a refund of your card’s available balance.

Need more details?

Check out the full cardholder agreement on SecureSpend’s official website.

And there you have it – everything you need to know to start shopping online securely with prepaid SecureSpend cards! No more worrying about identity theft or credit damage.

For additional questions, you can call their customer support line 24/7. Thanks for reading and happy secure spending!