If you’ve just received your shiny new American Express card, congratulations! Before you can start using it for purchases, there’s one important step you need to take: activating your card. Don’t worry, the process is quick and easy. In this guide, we’ll walk you through everything you need to know about American Express card activation.

Contents

Two Simple Ways to Activate Your Amex Card

There are two convenient methods for activating your American Express card:

- Online at americanexpress.com/confirmcard

- By phone at 1-800-362-6033

Most people prefer the online method these days, but if you’d rather talk to a real person, the phone option is always available. Let’s dive into the details of each.

Online Activation at Americanexpress.com/confirmcard

To activate your card online, you’ll need to have a few things ready:

- Your new American Express card

- A device with internet access (smartphone, tablet, laptop, or desktop)

- Your email address

- Personal information (name, address, date of birth, etc.)

- The 15-digit card number on your Amex card

- The 4-digit security code (CID) on your card

Got everything? Great! Here’s a step-by-step walkthrough:

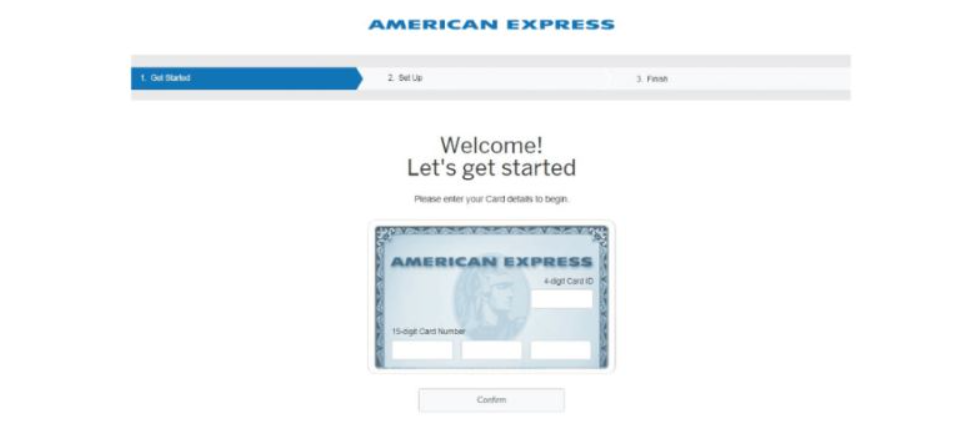

- Go to americanexpress.com/confirmcard in your web browser.

- Enter your 15-digit card number and 4-digit CID code as shown in the image on the page.

- Click “Confirm.”

- On the next page, sign in if you already have an Amex online account. If not, click “Create a New Online Account” and follow the prompts to sign up with your email and a password.

- Once logged in, verify that the card details shown are correct.

- Click “Confirm” to complete the activation process.

That’s it! You’ll see a confirmation message on the screen, and you’ll also get a text and/or email notification that your card is now active and ready to use.

Phone Activation

If you’d prefer to activate your card by phone, simply follow these steps:

- Call American Express at 1-800-362-6033.

- Follow the prompts to enter your card number and any other information requested.

- Once your identity is verified, your card will be activated.

American Express Card Eligibility and Benefits

To be approved for an American Express card, you typically need to meet some basic criteria:

- Be at least 18 years old

- Have a good credit score with no recent bankruptcies

- Have U.S. citizenship or permanent resident status

- Meet certain income requirements

Amex offers an exciting array of personal and business credit cards with different rewards, perks and annual fees. Some of the key benefits you can enjoy, depending on which card you have, include:

- Earning points on purchases that can be redeemed for travel, gift cards, merchandise and more

- Cash back on select spending categories

- Travel perks like lounge access, airline fee credits, and elite hotel status

- Shopping protections like extended warranties, purchase protection, and return protection

- Exclusive entertainment and dining experiences

- Amex Offers – bonus points or cash back for spending with specific merchants

About American Express

Founded in 1850, American Express is one of the oldest and most respected financial institutions in the world. Headquartered in New York City, the company provides a wide range of products and services including:

- Consumer and business credit cards

- Prepaid and gift cards

- Merchant payment processing

- Travel services

- Banking (through Amex’s online bank)

Some fun facts about Amex:

- The company started out as a freight forwarding service – it didn’t issue its first credit card until 1958!

- American Express cards are accepted by millions of merchants in over 160 countries worldwide.

- The Amex black Centurion card (invite-only) is one of the most exclusive credit cards in the world, with big spending requirements and a hefty annual fee.

I hope this guide has been helpful in walking you through the American Express card activation process! If you have any other questions, feel free to call the Amex customer service number on the back of your card. Here’s to happy spending with your new Amex!